Corporate News 2010

Making the Christmas season more meaningful for the sick, marginalized and underserved, employees of Chinatrust (Philippines) Commercial Bank recently visited the Pediatric Ward of the Philippine General Hospital (PGH), the country’s largest government healthcare institution. After raising funds from employees’ contributions, Chinatrust employee-volunteers purchased basic necessities and assembled these into over a hundred care packages which they distributed after entertaining and sharing holiday meals with the hospital’s patients and their families. Chinatrust Philippines has continuously taken pride in the high level of social awareness among its workforce and promoting volunteerism through various CSR initiatives to exemplify its corporate values and strengthen its thrust of being good corporate citizens.

Chinatrust (Philippines) Commercial Bank Corporation maintained its strong performance for January to September of the year, as it registered a net income of Php404 million, or 127 percent better than the Php178 million it posted for the same period last year, and already surpassing its full-year 2009 net income of Php333 million. This income performance translates to a 9.5 percent return on average equity and 2.14 percent return on average assets.

This healthy growth pattern was evident across all revenue sources, from the interest differential business, fixed income trading business and fee-based activities. Non-interest income rose by 90.84 percent mainly due to a hefty 170 percent increase in both trading and foreign exchange gains amounting to Php278 million from Php103 million last year.

“We are on track in our objective to improve our competitive position in the industry. The quality of our earnings has improved and our expenses remained under control. While we are quite satisfied with our performance, we expect better results in the coming years as we gain further economies of scale,” Mark Chen, president and Chief Executive Officer said.

The Bank maintained its conservative stance by setting aside provision for impairment of Php220 million. Its capital adequacy ratio (CAR) remains high versus the industry at 25.22 percent as of September 30, 2010, better than year-end CAR of 22.96 percent, and way above the regulatory requirement of 10 percent.

Opened as a full-service commercial Bank in the latter part of 1995, Chinatrust Philippines now has one of the largest branch networks among foreign banks in the country and is also deemed to be one of the most successful among many commercial banks that opened in that year.

In line with its efforts to pursue corporate citizenship activities specifically targeted to promote education at the grassroots level, Chinatrust (Philippines), a subsidiary of the largest and most-awarded private commercial bank in Taiwan, recently donated 20 computer units to five beneficiary elementary schools in the 1st District of Zamboanga del Sur through the Taipei Economic and Cultural Office in the Philippines (TECO). On hand to receive the donation (from left to right) from Chinatrust Philippines vice chairman William Go and president and CEO Mark Chen are: TECO representative Donald Lee, Congressman Victor Yu of the 1st District of Zamboanga del Sur and Supt. Victorina Perez, Pagadian City Division Schools Superintendent.

Chinatrust Philippines, a subsidiary of the largest and most awarded private commercial Bank in Taiwan, recently hosted an appreciation dinner for its clients and guests in celebration of its 15th anniversary. Among the more than 400 guests who greeted the Bank on its crystal anniversary were former President Fidel V. Ramos, Bangko Sentral ng Pilipinas Governor Amando Tetangco Jr. and Finance Secretary Cesar Purisima.

Also gracing the event at the NBC Tent at Bonifacio Global City in Taguig were Taipei Economic and Cultural Office representative Donald Lee, Manila Economic and Cultural Office representative Antonio Basilio, Communications Group Cabinet Secretary Sonny Coloma, former central bank Governor Gabriel Singson and former Senator Ramon Magsaysay, Jr.

The program started with the opening remarks from Chinatrust Philippines chairman William Hon. Mr. Hon then introduced Chinatrust Commercial Bank CEO for Institutional Banking Group James Chen who shared a video clip message of Dr. Jeffrey Koo, founder of Chinatrust Group and concurrent chairman of Chinatrust Commercial Bank and Chinatrust financial Holding Co., Ltd. As a special envoy of Dr. Koo, James Chen took the lead in echoing Dr. Koo’s ceremonial toast.

Guests feasted on marinated salmon roulade, a trio of mushroom consommé, baked sole filet bonne femme and US top blade steak, as well as chocolate roulade for dessert while being entertained by song numbers from The Company, pop star Bituin Escalante and high-energy performances from Whiplash.

In his taped message, Dr. Koo pledged Chinatrust’s continued support for the Philippines, noting that his decision to open an affiliate bank here 15 years ago was a good business decision and a source of personal pride.

“I have always been impressed by the beauty of the Philippines and the dynamism and resiliency of the Filipino people. Today, the Philippines stands at the threshold of new beginnings. Your country has a new president who brings with him a message of hope and vision of prosperous tomorrows,” Koo said in his speech.

This vision, he added, is shared by Chinatrust Philippines, which now has the second-biggest network among 17 foreign banks in the Philippines with its brand new office and 24 branches. “We stand ready to be your country’s partner in this undertaking,” Koo said, adding that the Bank would continue to be the government’s partner in enhancing business productivity and boosting the economy.

Meanwhile, the central bank governor cited the Bank for its strong financial position, having achieved a capital adequacy ratio of 23.8% — the highest, Tetangco said, among the three foreign banking units in the country. The BSP chief also thanked Chinatrust for boosting local capital markets, its practice of good governance and for supporting micro, small and medium enterprises. “This makes you a partner of the BSP in enhancing access to sustainable financial services and in promoting the MSME sector as a vehicle for broad-based economic growth,” Tetangco said.

“Definitely, the presence of global financial players like Chinatrust is a plus to our country. At the same time, given the many business opportunities available in our country today under President Noynoy Aquino, I can say with confidence that Chinatrust is in the right place, at the right time,” he added.

In bringing the celebration to a close, Mark Chen, Chinatrust Philippines president and CEO, said increased competition amid a volatile environment requires the Bank to continue its pursuit of excellence. “We are prepared to continue working harder and smarter to help you seize opportunities presented by both the local and global markets,” he told guests at the appreciation dinner.

Chinatrust Philippines is the local unit of Chinatrust Commercial Bank, one of the 200 biggest banks in the world in terms of capital. The parent bank had assets of more than $53 billion at the end of last year, and enjoys a credit rating unmatched by any local bank — A2 from Moody’s, A-minus from Standard and Poor’s and A from Fitch Ratings. The Philippine subsidiary, whose net profits increased by 173 percent to P234 million as of end-May, was set up in 1995 and is listed on the Philippine Stock Exchange.

(From L – R) CTP executive vice president and Head of Institutional Banking Group Marty Escalona; BSP Deputy Governor Nestor Espenilla; CTP vice chairman William Go, The Honorable Governor of BSP Amando Tetangco, Jr.; CTP chairman William Hon; president and CEO Mark Chen.

(From L – R) CTP executive vice president and Head of Institutional Banking Group Marty Escalona; BSP Deputy Governor Nestor Espenilla; CTP vice chairman William Go, The Honorable Governor of BSP Amando Tetangco, Jr.; CTP chairman William Hon; president and CEO Mark Chen.

(From L – R) CTCB CEO for Institutional Banking Group (and special envoy of Dr. Jeffrey Koo) James Chen; Taipei Economic and Cultural Office representative Hon. Donald Lee; CTCB senior executive vice president and secretary general Thomas Chen; CTP chairman William Hon and vice chairman William Go; McDonald’s Philippines chairman George Yang.

(From L – R) CTCB CEO for Institutional Banking Group (and special envoy of Dr. Jeffrey Koo) James Chen; Taipei Economic and Cultural Office representative Hon. Donald Lee; CTCB senior executive vice president and secretary general Thomas Chen; CTP chairman William Hon and vice chairman William Go; McDonald’s Philippines chairman George Yang.

(From L – R) Aurelio 'Gigi' Montinola, president of the Bankers Association of the Philippines and Bank of Philippine Island; CTP vice chairman William Go; chairman William Hon.

(From L – R) Aurelio 'Gigi' Montinola, president of the Bankers Association of the Philippines and Bank of Philippine Island; CTP vice chairman William Go; chairman William Hon.

(From L – R) CTP chairman William Hon; former president of the Philippines, Fidel V. Ramos; CTP vice president and Marketing Communications and Services Head Therese Arnaldo – Marin; CTCB senior executive vice president and secretary general Thomas Chen.

(From L – R) CTP chairman William Hon; former president of the Philippines, Fidel V. Ramos; CTP vice president and Marketing Communications and Services Head Therese Arnaldo – Marin; CTCB senior executive vice president and secretary general Thomas Chen.

Video clip message and ceremonial toast from Dr. Jeffrey Koo, founder of Chinatrust Group and concurrent chairman of CTCB and CFHC.

Video clip message and ceremonial toast from Dr. Jeffrey Koo, founder of Chinatrust Group and concurrent chairman of CTCB and CFHC.

Ceremonial Toast: (From L – R) CTP president and CEO Mark Chen; vice chairman William Go; chairman William Hon; CTCB CEO for Institutional Banking Group (and special envoy of Dr. Jeffrey Koo) James Chen; CTCB senior executive vice president and secretary general Thomas Chen; CTP directors Eric Wu and Larry Hsu.

Ceremonial Toast: (From L – R) CTP president and CEO Mark Chen; vice chairman William Go; chairman William Hon; CTCB CEO for Institutional Banking Group (and special envoy of Dr. Jeffrey Koo) James Chen; CTCB senior executive vice president and secretary general Thomas Chen; CTP directors Eric Wu and Larry Hsu.

Dinner entertainment provided by 'The Company'.

Dinner entertainment provided by 'The Company'.

Hi-energy dance number from 'Whiplash'.

Hi-energy dance number from 'Whiplash'.

Closing entertainment provided by the country's most versatile theatre actress and singer, the sultry Bituin Escalante.

Closing entertainment provided by the country's most versatile theatre actress and singer, the sultry Bituin Escalante.

The overall motif of the event is Crystal — an element that usually symbolizes 15 years. Structures made of crystal, ice and other reflective accents dominated the production design and staging at the NBC Tent, and the Bank's teal green corporate color was assimilated with the motif to serve as the overall color scheme.

The overall motif of the event is Crystal — an element that usually symbolizes 15 years. Structures made of crystal, ice and other reflective accents dominated the production design and staging at the NBC Tent, and the Bank's teal green corporate color was assimilated with the motif to serve as the overall color scheme.

Foreground shows Ice Crystal dècor and Philip Stark lamps lining up the tunnel to the main reception area.

Foreground shows Ice Crystal dècor and Philip Stark lamps lining up the tunnel to the main reception area.

To echo the Crystal element, ice sculptures were used on each table as a centerpiece.

To echo the Crystal element, ice sculptures were used on each table as a centerpiece.

Chinatrust Philippines, a subsidiary of the largest and most awarded private commercial bank in Taiwan recently hosted a cocktail reception to celebrate the inauguration and blessing of its new Head Office and branch located strategically at The Fort Legend Towers in Taguig City. Opened as a full service commercial bank in 1995, Chinatrust has one of the largest branch networks among foreign banks in the country and is also deemed to be one of the most successful among many commercial banks that opened in that year. On hand for the ceremonial tossing of the coins and candies are, from left: The Net Group president Carlos Rufino; Chinatrust Commercial Bank Institutional Banking Division Head for South East Asia Region Joseph Shih; Chinatrust (Philippines) Director Edwin Villanueva, Vice Chairman William Go, and president and CEO Mark Chen; Morning Star Milling Corp. Chairman Vicente Lim; and Chinatrust (Philippines) Chairman William Hon.

Chinatrust (Philippines) Commercial Bank Corporation, a subsidiary of the largest and most awarded private commercial bank in Taiwan, reported yesterday that the Bank’s net income amounted to P234 million in the first five months of 2010, a 173 percent increase from the P85.7 million it recorded for the same period the previous year.

The sharp increase in the Bank’s profitability was equally attributed to the Bank’s net interest differential business which generated an income of P666.9 million as of month-end May 2010, or an increase of P91.6 million over the P575.3 million generated the previous year. The Bank’s combined fixed income trading and foreign exchange operations, in turn, generated a combined income of P89.3 million, which is 180% higher than the P31.9 million generated for the same period last year.

"The Bank is now reaping the benefits of a rationalized service delivery system and consolidated operations,” Chinatrust president and CEO Mark Chen explained. “It should be recalled that the Bank invested heavily in its information technology and service delivery infrastructure last year in the effort to build a stable platform for sustainable growth. Our financial performance for the first five months of this year would indicate that we are now starting to benefit from these investments.”

Chinatrust Philippines has one of the largest branch networks among foreign banks in the country, with 23 branches nationwide. The Bank is set to open another branch at the Bonifacio Global City, Taguig City this month.

CTCB Chairman pays courtesy call to the BSP Governor. In his recent visit to the Philippines, Chinatrust Commercial Bank (CTCB) Chairman Michael B. DeNoma paid a courtesy call to Governor Amando M. Tetangco, Jr. of the Bangko Sentral ng Pilipinas (BSP). The Chairman of the Taiwan-based financial conglomerate was in the country as part of an international road show to cascade the Bank’s global Mission, Vision and Values to all CTCB branches and subsidiaries worldwide. Present during the visit are (from left) Chinatrust (Philippines) President and CEO Mark Chen and Vice Chairman William B. Go, BSP Deputy Governor Nestor A. Espenilla, Jr., Governor Tetangco, Mr. DeNoma, and Chinatrust (Philippines) Chairman William T.Y. Hon. During the courtesy call, both sides took the opportunity to exchange views of mutual concern which aimed to forge a stronger collaboration between the Bank and the regulatory body.

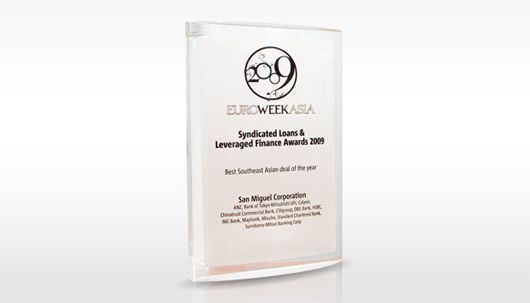

EuroWeek Asia edition, the Newspaper of the Global Capital Markets, announced last February 4, 2010 the winners of their third annual syndicated loans and leveraged finance awards, honouring deals and houses that impressed the market in 2009. Last year was one of the most difficult in decades, with transaction volumes and the number of deals down across the region. But the Asian loan market bounced back strongly in the second half of the year, and that recovery owed much to the skill and determination of the region’s loan bankers. The results are determined by a poll of market participants conducted by the EuroWeek team in December.

For the EuroWeek Asia Award Year 2009, San Miguel Corporation was awarded the "Best Southeast Asian Deal of the year 2009" for its US$600 million Syndicated Term Facility signed in September 2009 with several major foreign banks. Chinatrust (Phils.) Commercial Bank was one of the joint-arrangers for said term loan transaction.

EuroWeek also awarded the parent bank, Chinatrust Commercial Bank Ltd., as the "Best Arranger of Taiwanese Loans for year 2009".

EuroWeek is the leading weekly newspaper of the international capital markets, with a unique blend of news, analysis and industry gossip published in London.

Chinatrust Philippines and LBC Express, Inc. recently formalized its partnership with the signing of a Memorandum of Agreement (MOA). Chinatrust enlisted LBC Express to accept over-the-counter cash payments from the Bank’s Salary Stretch loan borrowers in its over 800 outlets nationwide. Aside from LBC Express, loan borrowers can also pay their loan through BancNet ATMs, BancNet Online, UnionBank branches, and in all Chinatrust branches. Signing the MOA are (seated from left) Judy Pascua, LBC Express’ Financial Services Head for Global Remittance; Anthony Robles, Chinatrust Philippines’ Executive Vice President and Retail Banking Group Head; Janet Ong, LBC Express’ Chief Operating Officer for Global Remittance. Also present to witness the signing are (standing from left) Vilma Noche, Chinatrust Philippines’ Senior Vice President for Banking Operations and Ed Ibazeta, LBC Express’ Account Executive.